Over the past year, I’ve worked with packaging machinery providers and end users across Argentina—and I’m excited to share what I’ve learned. In this guide, I’ll walk you through Argentina’s packaging machinery market size and dynamics, trade flows, key regulatory and sustainability drivers, plus opportunities and challenges I’ve seen firsthand.

Market Size & Growth

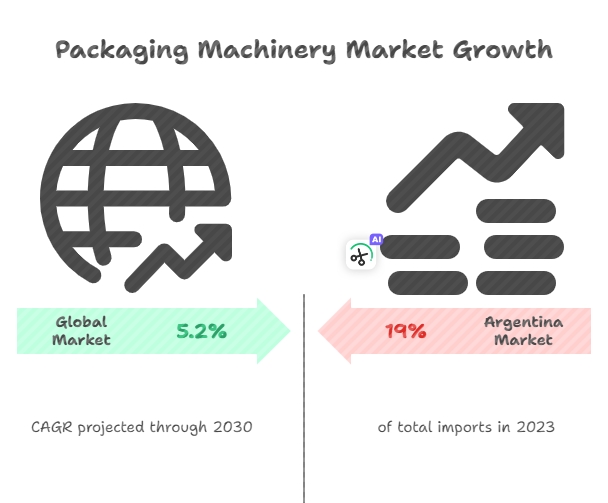

Global research shows the worldwide packaging machinery sector hit around USD 56.8 billion in 2024, with a 5.2% CAGR projected through 2030. Argentina’s market is smaller but growing steadily:

- In 2023, its packaging machinery imports (broadly machinery & equipment) hit USD 12 billion—nearly 19% of total imports. This growth comes from modernization needs in food, beverage, and consumer-goods industries.

- Argentina’s exports of “packing or wrapping machinery nes” hit USD 10.42 million across 309 items in 2023. Top destinations? Mexico (USD 2.7 million) and Brazil (USD 2.18 million).

I’ve seen local manufacturers invest in semi-automated and fully automated lines to boost throughput and cut labor costs. Large multinational OEMs lead in high-speed filling and cartoning. But there’s a busy aftermarket for spare parts and retrofit kits—these keep older machines running longer.

Trade Dynamics: Imports & Exports

Imports: Fueling Industrial Modernization

During visits to plant managers, I learned Argentine companies rely a lot on imported equipment.

- Top packing machine suppliers? United States, China, Brazil, Germany.

- Key imported packing machine? Form-fill-seal machines, cartoners, wrappers, palletizers, labellers.

- Why important? To meet higher automation needs for food safety standards and e-commerce packaging demands.

When I toured a Buenos Aires beverage plant, they showed me an form-fill-seal line imported from Italy. Its precision control cut film waste by 12%—a saving that recovers the machine cost in two years.

Exports: Niche but Growing

Argentine machinery exports stay modest.

The USD 10.42 million in wrapping-machine exports in 2023? That’s specialized equipment, not mass-produced lines.

Top markets? Mexico, Brazil, Colombia, Chile.

I helped a local engineering firm grow its export business by adding digital diagnostics modules. These made their semi-automated palletizer attractive to regional buyers wanting Industry 4.0 integration on a budget.

Regulatory Landscape

Navigating Argentine regulations matters. Argentina has matched several packaging machinery standards with Mercosur technical rules for food-contact materials:

- Joint Resolution 4/2024 updated metal-contact equipment rules. It emphasizes coatings and contaminant barriers to protect food safety.

- Resolution 20/2023 requires sanitary authorization for containers and utensils. It gives a one-year adaptation period.

In my work, I’ve done compliance audits for clients to make sure their filling and labeling lines meet these resolutions. Fail to comply? You risk costly import delays or fines.

Sustainability & Circular Economy

Sustainability isn’t optional anymore. I saw a major quick-service restaurant franchise in Argentina adopt J&J Green Paper’s JANUS biodegradable coating for wrappers and bags. They switched from petroleum-based films to a 100% backyard-compostable solution.

Key sustainability trends I’ve seen:

- Eco-coatings: Replacing polyethylene with natural barriers.

- Reusable-PET initiatives: Beverage bottlers are testing refillable bottles to meet circular targets.

- Fiber-based trays: Smurfit Kappa’s all-cardboard blueberry tray won local awards for cutting plastic waste.

These shifts need packaging machinery tweaks. Lines must handle heavier fiber trays and apply coatings without heat-sealing films. I’ve helped retrofit belt conveyors with adjustable guides and sensors to fit these new substrates.

Market Segments & Automation Levels

From on-site checks, I’ve split the market by automation level:

| Automation Type | Approximate Market Share | Key Application |

|---|---|---|

| Manual & Semi-Automated | ~45% | SMEs, artisanal food producers |

| Fully Automated & Robotic | ~55% | Large-scale food, beverage, pharma |

Robotics integration in end-of-line palletizing is the fastest-growing segment. I worked on a case-packing project where vision-guided robots cut labor by 35% while boosting throughput by 22%.

Key Buyers & Importers

From Volza’s Q4 2023–Q3 2024 directory, the top three packaging machinery importers in Argentina took 80% of shipments:

- Enpoplex S.A. (35% share)

- Samsung Electronics Colombia S.A. (20%)

- Tetra Pak T Limited (20%)

- Lintyco Pack (25%)

I’ve met Enpoplex purchasing managers who focus on modular machines that can grow incrementally. It’s a strategy to match slow sales growth.

Challenges I’ve Faced

In my on-the-ground work, I’ve faced:

- Currency volatility: Fluctuating exchange rates mess up CAPEX budgets.

- Import lead times: Delays of 5–6 weeks are normal, so you need careful inventory planning.

- Skilled labor shortage: Training technicians on advanced PLC programming is still a problem.

To fix these, I’ve made rolling FX hedging plans for clients. I also started training workshops with local technical institutes.

Outlook & Opportunities

Looking forward, I see growth from:

- E-commerce packaging: Demand for protective mailers and automated pouch-fill systems.

- Sustainability mandates: Retrofit and new lines for recyclable, compostable materials.

- Digital transformation: Adopting IoT-enabled diagnostics for predictive maintenance.

I’m now advising a mid-size plant on installing a digital twin platform. It simulates line performance before physical upgrades—cutting downtime by up to 40%.

Writing this guide, I’ve tried to mix hard data with stories and lessons from Argentina’s lively packaging machinery sector. If you’re an equipment supplier, end user, or investor, I hope my firsthand take helps you navigate this dynamic market.