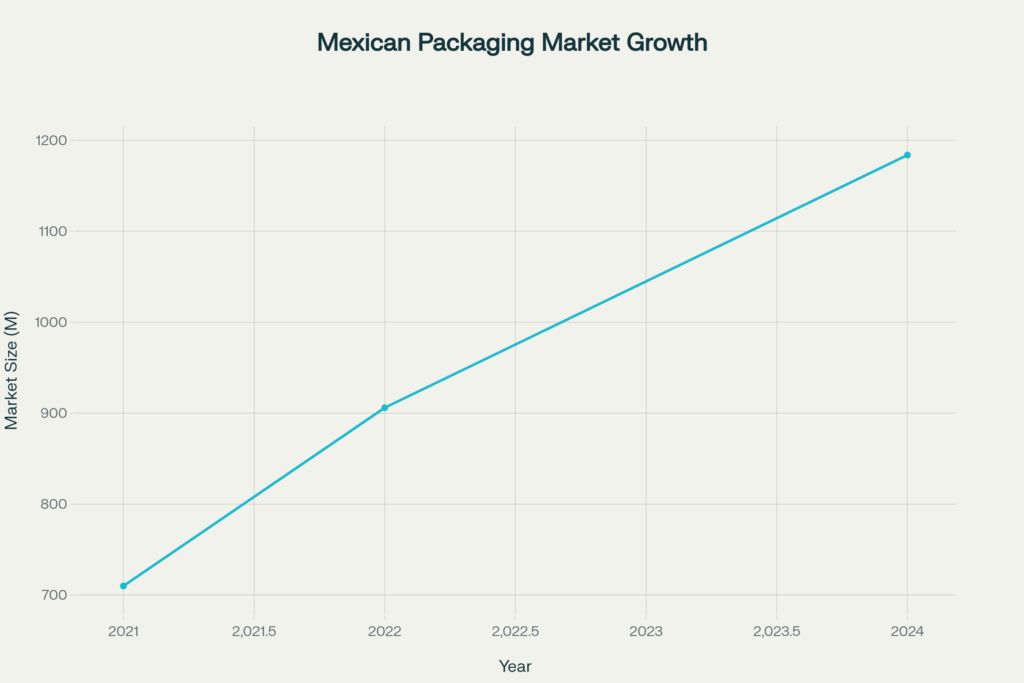

The Mexican packaging machinery market has rebounded strongly since 2020, reaching USD 906 million in 2022 from USD 710 million in 2021 and further expanding to USD 1,183.8 million by 2024. This growth reflects:

- A 25% year-on-year surge in 2022 after three years of stagnation1.

- A 4.6% CAGR projected from 2025 to 2030, aiming for USD 1,538.3 million by 2030.

- Flexible packaging accounting for 63% of food applications, growing over 10% annually due to sustainability and shelf-life demands.

Why Demand Increse So Fast?

Businesses in Mexico’s consumer packaged goods (CPG) sector are increasingly investing in modern packaging machinery to stay competitive, boost efficiency, and meet evolving market demands. Below, I expand on the five key drivers—capacity expansion, obsolete-equipment replacement, automation, new SKUs, and sustainability—and illustrate each with the latest data.

Capacity Expansion: Meeting Surging Demand

Consumer demand for food and beverages in Mexico has escalated rapidly:

- In 2022, the Mexican packaging and processing machinery market grew by 25% to USD 906 million, rebounding after three years of stagnation.

- E-commerce growth of 23% in 2022—driven by USD 47.5 billion in online retail sales—prompted companies to lease new distribution space and install specialized packaging lines for faster fulfillment and varied SKUs.

- Between 2021 and Q3 2024, over 3.5 million m² of industrial space was leased in the Mexico City metro area to support e-commerce and retail packaging expansion.

Replacement of Obsolete Equipment: Modernization Imperative

Aging machinery curtails reliability and output:

- Over 50% of Mexican CPG companies reported investing in equipment modernization in 2023, replacing outdated machines with advanced imported technologies to boost production uptime and product quality.

- Government support programs—USD 32.8 billion in social spending and USD 58.5 billion in remittances in 2022—have fueled consumption of processed foods and beverages, further motivating firms to upgrade their lines.

Modernization is no longer optional; it’s a strategic necessity to maintain competitiveness.

Automation: Cutting Costs and Errors

Rising labor costs and regulatory pressures drive automation adoption:

- Demand for packaging machinery surged 25% in 2022 as food, beverage, and pharmaceutical makers invested in robotic case packers, machine-vision systems, and AI-enabled maintenance diagnostics to reduce downtime and labor expenses2.

- In 2023, Mexican companies increased machinery investments by 5–40% year-over-year, with a significant share dedicated to automation solutions like conveyors, sensors, and collaborative robots3.

- The packaging automation market in Latin America is forecast to grow at a 7.2% CAGR, with Mexico leading due to stable economics and strong industry investment4.

Automation not only safeguards quality and consistency but also slashes operational expenditures over time.

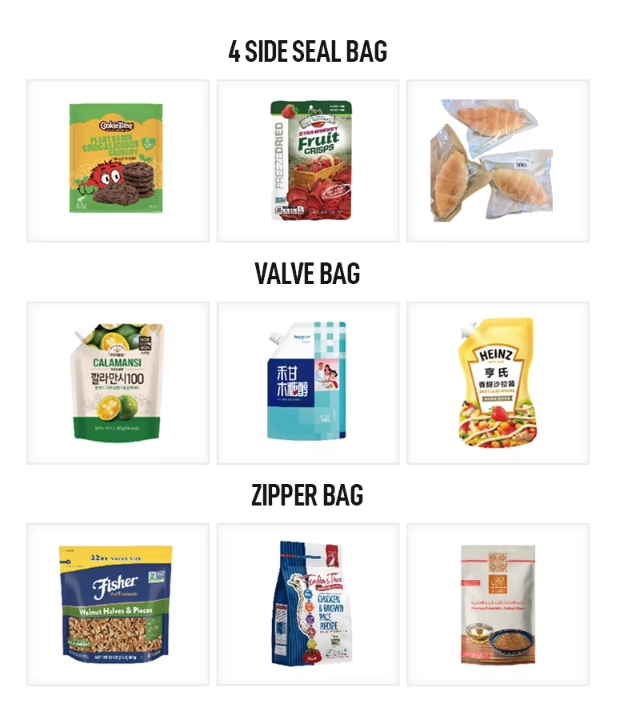

Flexibility Package Update

CPG firms are diversifying product lines at unprecedented rates:

- Flexible packaging—pouches, sachets, and multi-format FFS lines—accounts for 63% of food packaging applications and is growing at over 10% annually.

- Many companies reported launching multiple new SKUs in 2023 to meet niche consumer preferences, necessitating versatile machinery capable of rapid format changeovers (5 – 10 minutes versus hours on older lines).

- E-commerce’s demand for varied package sizes and protective formats has further amplified the requirement for quick-change capabilities on packaging lines.

This trend underscores why agility—via modular, multi-format machines—is crucial.

Sustainability

Environmental mandates and green consumerism are accelerating sustainable packaging:

- Mexico’s green packaging market reached USD 4,068 million in 2024 and is projected to grow at a 4.4% CAGR through 2033, driven by biodegradable and recyclable material adoption.

- The broader sustainable packaging sector generated USD 17.7 billion in revenues in 2023, with a 3.6% CAGR since 2018, reflecting tighter regulations and corporate ESG commitments.

- The impending “Ley General de Envases y Contenedores”—plus state bans on non-biodegradables—compels CPG companies to invest in equipment that can handle paper-based, PLA, and other eco-friendly substrates.

Investing now in sustainable machinery ensures compliance and aligns with consumer demand for greener products.

The Main Types of Packaging Machines

Here’s what you’ll run into most across industries (food, personal care, pharma—you name it):

- Filling Machines: Handle solids, liquids, powders, granules. Automatic snack packaging like we do at Lintyco Pack—super fast, consistent, and sealed for freshness.

- Form-Fill-Seal (FFS): Vertical (VFFS) or horizontal (HFFS), these make and fill bags or pouches. Our vertical machines hit 60 bags/min, while our flow wrappers run faster than 200 bags/min.

- Box and Cartoning Machines: Fold, fill, close, and seal boxes or cartons—perfect for retail and shipping.

- Labelling & Coding: Consistent, automated product identification keeps the whole supply chain smooth.

- Palletizing/Depalletizing: Automates stacking and unpacking, a must for high-volume operations.

What to Look for in Packaging Machinery?

Choosing the right partner is crucial. I always recommend:

- Flexibility—to handle different products and sizes.

- Speed—because the market moves fast.

- Durability—machinery should last and adapt.

- Support—local service counts when things go wrong.

That’s where Lintyco Pack comes in. With nearly 20 years of expertise and a client base spanning over 190 countries, we know what it takes

Top Packaging Machine Suppliers in Mexico

- Lintyco Pack: FFS, cartoning, labeling, end-of-line.

- Supertech Packing: pouch machines, auger fillers.

- Ronchi LatAm: bottles, cappers, fillers.

- U Tech: liquid fillers and capping systems.

- Packett MX: fruit & veg packers.

For deeper dives, check our post on pouch packaging trends and automation tips.

Why Work with Lintyco Pack?

Here’s where I’d like to tell you what we do—honestly, without the hard sell. We’ve spent nearly 20 years supplying packaging solutions to more than 190 countries. Our equipment covers everything from snacks to liquids, granules to non-foods. We focus on easy-to-use, flexible lines that can scale up with you.

- Speed & Productivity: Up to 3600 bags/hour (VFFS), up to 290 bags/min for flow wrap.

- Custom Solutions: Need something unique? We design complete lines.

- Service: Local support means you’re not left waiting.

I recommend checking out our packaging guides and machine demos—they’ll give you an even better idea of what’s possible.

How to Choose?

Here’s my quick checklist:

- What’s your product? Liquids, powders, snacks, hardware—each needs the right machine.

- How many units per day? Match your speed to sales projections.

- Future plans? Go modular so you can add or change packs as you grow.

- Compliance & Green Goals? Mexico’s moving toward mandatory eco rules.

Want to Talk About Your Needs?

Choosing the right packaging machinery for your business in Mexico can make a huge difference. I’m excited to help guide you. Reach out to Lintyco Pack—we’ll find a solution tailored for you, whether you’re packaging snacks, frozen foods, or cosmetics.

Ready to take your packaging to the next level? I’d love to be part of your journey.